colorado electric vehicle tax incentive

Receive 50 or up to 250 for the purchase of a new or used plug-in hybrid PHEV vehicle. Local and Utility Incentives.

Joseph Biden Aims To Improve Us Ev Tax Credit Restore It For Tesla Gm Electric Cars Tesla Fuel Cost

Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year.

. The Colorado Energy Office ReCharge Colorado program works to advance the adoption of electric vehicles EVs and installation of charging infrastructure across the state. Drive Electric Colorado exists to provide you individual consumers with information about electric vehicles in Colorado. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles.

Park Chaffee Fremont Custer El Paso Pueblo Elbert Lincoln Crowley Kit Carson Cheyenne Kiowa. Low Emission Vehicle LEV Sales Tax Exemption. There are so many incentives available for consumers interested in purchasing or leasing an electric vehicle or installing a charger.

Fort Collins offers a 250kW incentive up to 1000 filed on behalf of the. So weve got 5500 off a new EV purchase or lease and 3000 off of used. The credits decrease every few years from 2500 during January 2021 2023 to 2000 from 2023-2026.

If you have any questions dont hesitate to contact us at Drive Electric Colorado. Contact Us New EVsPHEVsCO State Tax Credit. For more on federal tax incentives see the bottom of this section.

Contact the Colorado Department of Revenue at 3032387378. Some dealers offer this at point of sale. Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle.

As of 2021 Colorado offers a vehicle-related incentive for new EVs light passenger vehicles up to 2500. For assistance in finding the right EV for you contact a coach. The Xcel Energy rebates come as the value of Colorados electric vehicle tax incentive has shrunk.

If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69. UtilityPrivate Incentives Electric Vehicle EV Charging Station Incentive Holy Cross Energy HCE. Electric Vehicle EV Tax Credit.

State Incentives Electric Vehicle EV Tax Credit. This tax credit goes down to 2500 on January 1 2021 so buy your car now to take advantage of the 4000 credit. Tax credits are as follows for vehicles purchased between 2021 and 2026.

The credits which began phasing out in January will expire by Jan. Learn about the variety of electric vehicle models and the discounts you can take advantage of from trusted dealerships around Colorado on our EV Deals page. Light duty electric trucks have a gross vehicle weight rating GVWR of less than 10000 lbs.

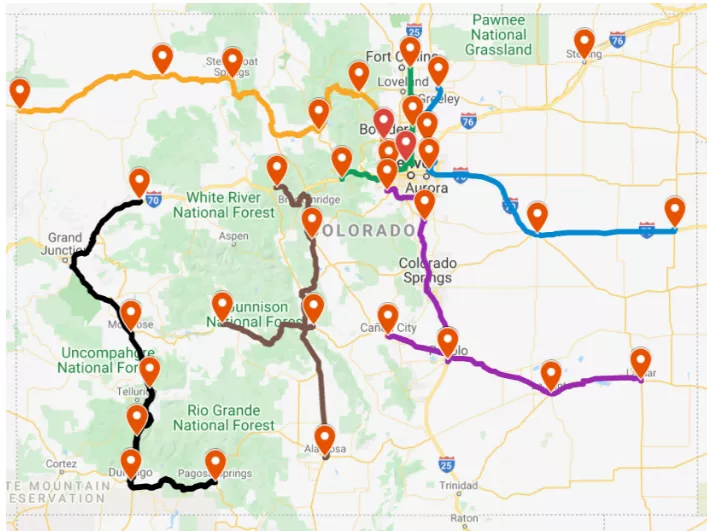

Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles in lieu of state tax credit. Receive 50 or up to 250 for a new or used NEV neighborhood electric vehicle less than 3000 lbs Apply for EV purchase rebates here. The 2018 Colorado Electric Vehicle Plan In January of 2018 Colorado released its first electric vehicle plan9 The 2018 Colorado Electric Vehicle Plan was the result of Executive Order D 2017-015 which directed CEO and partner agencies to develop a plan for building out EV fast-charging corridor stations across the state to facilitate economic.

For tax years January 1 2010 January 1. Colorados tax credits for EV purchases. Up to 7500Xcel Energy Rebate.

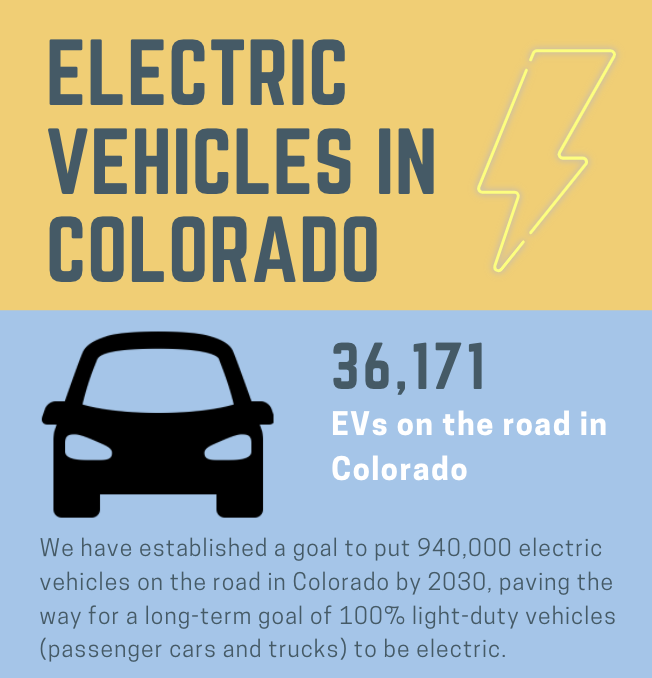

Qualified EVs titled and registered in Colorado are eligible for a tax credit. Tax credits can be stacked with federal EV incentives and will decrease in value after 2020 dropping to 2500 in 2023 and 2000 in 2026. EVs in Colorado as of January 1 2022.

Electric Vehicles Solar and Energy Storage. Xcels new vehicle lease or purchase rebates are richer than Colorados state new EV tax credit which in 2021 fell to 2500 per vehicle Sobczak noted. The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same.

Examples of electric vehicles include. Medium duty electric trucks have a GVWR of 10000 pounds to 26000 pounds. The state offers tax incentives on new purchases of electric and plug-in hybrid vehicles.

Colorado EV Incentives for Leases. Qualified EVs titled and registered in Colorado are eligible for a tax credit. You can lease an electric vehicle instead and get 2500 by the end of the year.

The table below outlines the tax credits for qualifying vehicles. New EV and PHEV buyers can claim a 5000 credit on their income tax return. Many leased EVs also qualify for a credit of 2000 this.

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. Use the following as a starting place as you dig deeper into. Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year.

To find a list of charging stations near you visit the Alternative Fuels Data Center or PlugShare. Colorado offers its green drivers the following state tax and sales tax incentives. Under most emission and rebate rules plug-in hybrids that combine a gasoline engine with a.

There is also a federal tax credit available up to 7500 depending on the cars battery capacity. Information in this list is updated throughout the year and comprehensively reviewed annually after Colorados legislative session ends. The tax credit for most innovative fuel vehicles is set to expire on January 1 2022.

How much can I save with the Colorado electric vehicle incentive. Alternative Fuel Vehicle AFV Tax Credit. The original 5000 tax credit was one of the countys most generous when it went into effect.

Trucks are eligible for a higher incentive. We have established a goal to put 940000 electric vehicles on the road in Colorado by 2030 paving the way for a long-term goal of 100 light-duty vehicles passenger cars and. Alternative Fuel Advanced Vehicle and Idle Reduction Technology Tax Credit.

Chevy Bolt Chevy Bolt EUV Tesla Model 3 Kia Niro EV Nissan LEAF Hyundai Kona EV Audi e-tron Rivian R1T Porsche. 1500 between 2021 to 2026. President Bidens EV tax credit builds on top of the existing federal EV incentive.

CEO is accepting applications for the ALT Fuels Colorado. In the end the utility commission approved a three-year 110 million program with 5 million in incentives for low-income customers. Receive 50 or up to 750 for the purchase of a new or used all-electric vehicle.

For more information about Charge Ahead Colorado contact Matt Mines Colorado Energy Office at mattminesstatecous or 3038662128. 2500 for a new EV or 1500 for 2-year leaseFederal Tax Credit. Xcel Energy offers 500 Home Wiring Rebate for L2 Residential Charger.

Colorado Electric Vehicle Sticker Hyundai Ioniq Forum

Biden Goal For U S Transition To Electric Vehicles Cast Into Doubt At U S Senate Hearing Colorado Newsline

How Do Electric Car Tax Credits Work Credit Karma

Here S The Scoop On Colorado Ev Policy July 2019 Drive Electric Northern Colorado

Colorado Ev Incentives Ev Connect

Tax Credits Drive Electric Colorado

Electric Vehicles In Colorado Report May 2021

Colorado Transportation Bill Paves The Way For Electric Transportation

Zero Emission Vehicle Tax Credits Colorado Energy Office

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Colorado Charges Electric Vehicle Owners 50 A Year After Giving Them Back 5 000 Denverite The Denver Site

Tax Credits City Of Fort Collins

Electric Vehicle License Plate Bill Passes

Northern Colorado Clean Cities Ev Group Buy Program Fort Collins Kia Drive Electric Colorado

Tax Credits Drive Electric Northern Colorado

Tax Credits Drive Electric Colorado

Get A New Nissan Leaf As Low As 11 510 After Incentives In Kansas Or Missouri Nissan Leaf Nissan Best Hybrid Cars

Colorado Vanity License Plate Promotes Tesla Evs Renewable Energy Solarchargeddriving Com